Mukka Proteins IPO Listing Tomorrow: Decoding GMP, Subscription & Listing Day Expectations

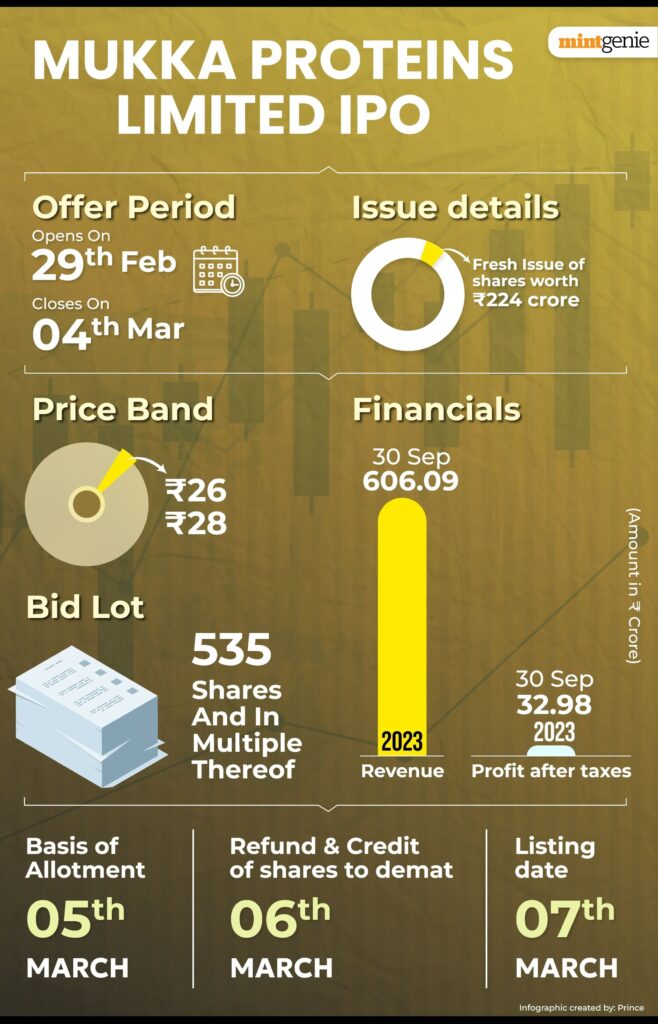

Mukka Proteins Limited, a company focused on processing and exporting plant-based protein products, is set to debut on the Indian stock exchanges tomorrow, March 7th, 2024. The IPO, which opened for subscription on February 29th and closed on March 4th, generated significant buzz with its robust performance. This article dives into the key factors that might influence the listing price, including the Grey Market Premium (GMP), subscription status, and expert analysis.

Mukka Proteins IPO Listing Tomorrow Grey Market Premium (GMP):

The GMP, an unofficial indicator of potential listing price in the unlisted market, has been a topic of much discussion for Mukka Proteins. As of March 5th, the GMP hovered around ₹35 per share. This translates to an estimated listing price of ₹63 per share, a significant premium of 125% over the issue price of ₹26-₹28 per share.

It’s important to remember that the GMP is not an exact science. It reflects market sentiments and can be volatile. However, a consistently high GMP, like the one observed for Mukka Proteins, suggests strong investor interest and a potential premium listing.

Mukka Proteins IPO Listing Tomorrow Subscription Status:

The subscription status of the Mukka Proteins IPO provides another crucial data point. The issue received overwhelming investor response, with an overall subscription ratio of 136.99 times. This means that for every share offered, investors bid for it over 136 times.

Further breakdown reveals even stronger participation across investor categories:

- Qualified Institutional Buyers (QIBs): This category, comprising institutional investors like mutual funds and insurance companies, subscribed their portion a staggering 189.28 times.

- Non-Institutional Investors (NIIs): This segment, which includes high net-worth individuals and corporate entities, subscribed their portion 250.24 times.

- Retail Individual Investors (RIIs): Retail investors also showed strong interest, subscribing their portion 58.33 times.

Such a robust subscription across all investor categories signifies strong market confidence in Mukka Proteins’ future prospects.

Mukka Proteins IPO Listing Tomorrow Beyond GMP and Subscriptions:

While GMP and subscription status offer valuable insights, other factors can also influence the listing price:

- Market Conditions: The overall performance of the stock market on the listing day can significantly impact the listing price. A bullish market generally translates to a higher listing price.

- Company Financials: A company’s financial health, future growth prospects, and industry outlook play a crucial role in determining investor interest and listing price.

- Demand-Supply Dynamics: The interplay of demand and supply on the listing day will ultimately determine the equilibrium price at which the stock trades.

Mukka Proteins IPO Listing Tomorrow Expert Opinions on Mukka Proteins Listing

Market analysts are cautiously optimistic about Mukka Proteins’ listing. Here’s a glimpse into what some experts have to say:

- Analyst 1: “The strong subscription numbers and positive GMP indicate a likely premium listing. However, market conditions on the listing day will be crucial.”

- Analyst 2: “Mukka Proteins operates in a high-growth industry with increasing demand for plant-based protein products. This bodes well for the company’s long-term prospects.”

- Analyst 3: “Investors should carefully consider the company’s fundamentals, future plans, and overall risk profile before making any investment decisions.”

On March 7th, when Mukka Proteins’ shares are listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), there will likely be high volatility in the initial trading hours. The opening price will depend on the interplay of various factors mentioned earlier.

Investors, particularly retail investors, are advised to exercise caution and adopt a long-term perspective. They should conduct their own research, understand the company’s fundamentals, and consult with a financial advisor before making any investment decisions.

Also Read:Gopal Snacks IPO: Date, Price A Bite-Sized Look Before Their Big IPO Launch

Key Takeaways

- Mukka Proteins’ IPO received a strong response from investors, with a subscription ratio exceeding 136 times.

- The high GMP of ₹35 per share indicates potential listing at a premium.

- Market conditions, company financials, and demand-supply dynamics will influence the final listing price.

- Investors should conduct thorough research and adopt a long-term view before investing.

The Mukka Proteins IPO listing is a significant event for the Indian stock market, particularly for the plant-based protein sector. While the listing day promises to be an exciting one, investors should prioritize a well-informed approach over short-term gains.